This article was originally posted at Axel Standard, a platform for cloud accountants and SaaS applications.

In western countries, rigorous business normally establishes sound internal control mechanisms to protect assets, smooth business operations and prevent risks from materializing into losses etc. However, after replicating these procedures into China operations, expatriate managers still often encounter surprising control problems.

From experiences of providing advisory service to our clients, business operations considered as low risk and managed with commonly used control approaches in developed countries fall into high risk areas in China as a result of unique business environment. Those risks are overlooked by expatriate managers very often with serious consequences.

By taking consideration of environmental, cultural and value differences, management should reassess business policies and operational measures to limit exposure to those China-specific risks. Special treatment is needed here rather than applying a solution cloned from your homeland.

In this article, we pick 3 areas where risks and problems are frequently seen, and explicate how these areas of risks can be better addressed, so that potential problems won’t become real ones:

- Sales and Receivables

- Expense Reimbursement

- Inventory Management

Sales And Receivables

Company A is a small medical devices trading company. This company found that a product requested by one of resigned salespersons’ clients was never supplied before. After investigation, company A discovered that the resigned sales sold similar products to Company’s client through another company under her own name, not once but many years.

This is not an absurd story but a real case of our client. After this scandal, Company A sought help from us. We found that as a result of this fraudulent behavior, sales of product replaced were constantly dropping over periods. Company A’s accountants failed to discover the sales decrease nor deter this corruption in time, which resulted in the company suffering huge loss of revenue.

What happened to company A is very common in China. But this is just a tip of the iceberg. There are some other issues about sales operation that may go beyond your expectations.

In small companies, sales are usually responsible for signing contracts. There are no segregation of duties between salespersons and contract signers, where fraud can happen especially when revenue triggers salesperson’s bonus. Salesperson may choose to fabricate false contracts where the client of the contract doesn’t really exist. If there is any contract that is signed a long time ago with no payment received, this can be an alert for checking contract authenticity.

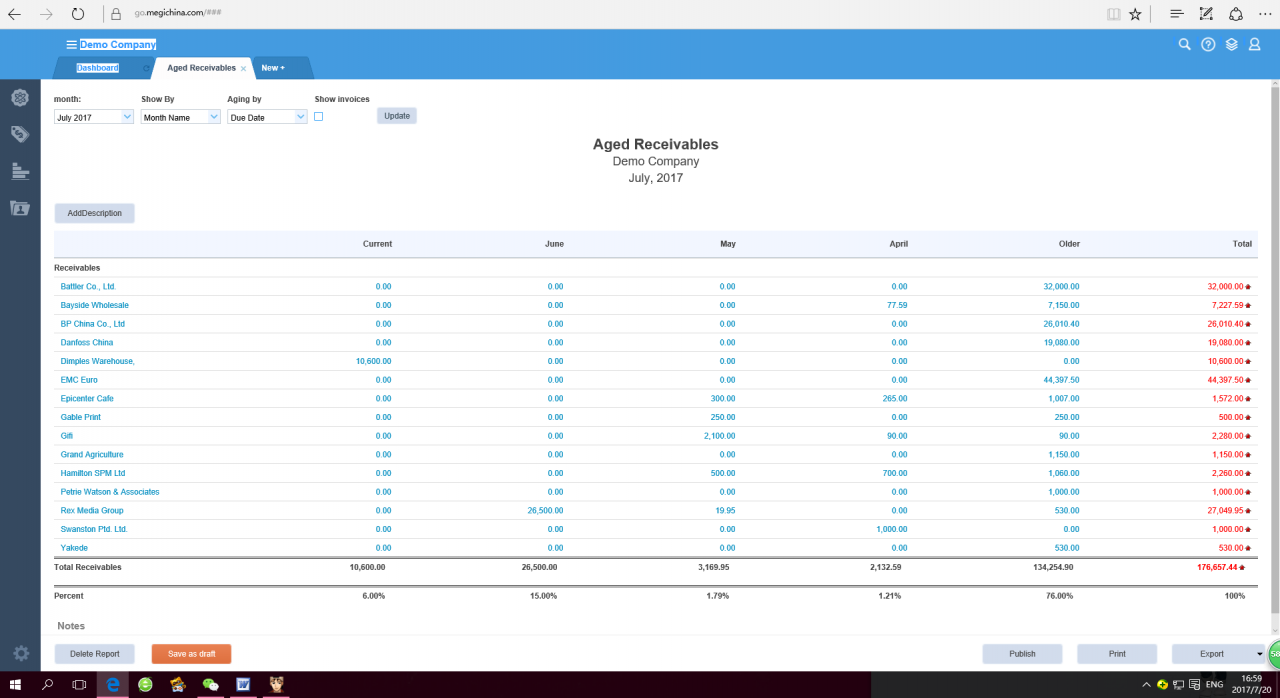

Receivable, a related area to sales operation, usually is vulnerable to many risks as well. Receivables should normally be cleared on-time based on credit terms offered to your clients. However, in China, this is frequently not the case, as clients may deliberately delay the payment and irresponsible employees may choose not to follow up delayed payment as long as they get their salaries paid. It is not uncommon that receivables get aged for a very long period, long enough to cause a liquidity problem.

How to address issues above

For Company A, we started to monitor their sales volume from different dimensions by clients, sales and products using MEGI as a software platform. Any movements above 5% are alerted and investigated by our advisors. As fluctuation in sales volume is tracked and monitored carefully, such tremendous money loss never took place again.

Receivable-aging analysis and chasing procedures should be established to prevent receivable problems from going out of control. Online accounting software is an ideal choice here for producing a real-time aging analysis with best efficiency and accuracy. For contract management, segregation of duties should be put in place. If this cannot be implemented due to the company size, contracts that are unpaid over 3-6 months need to be checked and verified with contract signers.

Expense Reimbursement

Company B, a business with over 50% gross profit margin, was running in losses for years. We were contacted to find out the reasons.

This company had a policy to make monthly provision for expense of 30,000 RMB to each one of the 5 salespersons which totaled to 1.8 million RMB per year. This large provision was very abnormal especially when sales performance was poor which cautioned us about integrity issue of employees. This situation was investigated and fraud was confirmed afterwards by our advisors. Locally hired General Manager colluded with sales and took up more provisions than they should by using irrelevant fapiaos for expense claims.

This is not a rare case. Local employees tend to ‘use up’ all expense provisions by providing work-irrelevant fapiaos. Even when there is no provision available, staffs may choose to claim improper reimbursement than they should by conducting manipulations.

Timely claim of expense is another target that is rarely achieved by local staffs. Claiming expense in incorrect accounting period affects the true and fair of accounting reports and accuracy of cash flow budgeting of your business. Existing internal control procedures used in western countries for managing expense reimbursement are not sufficient to cover all those local intricacies

How to address issues above

Management should decide whether provision for expense is necessary by analyzing and understanding your business historical data. Fapiaos should always be checked for validity based on predefined criteria.

By using mobile expense management applications, like “Xi Bao Xiao”, management can set criteria for valid fapiao in the system in advance. Only eligible fapiaos will be approved by the manager. Predetermined amount can be set for claims and anything above the “roof” will be sent to the approver for examination.

To control claim time, management can require employees to upload fapiaos to the mobile application within 2 hours of fapiaos’ issuance time, otherwise claims will be deemed as invalid. This policy leaves employees little room to collect false fapiao and claim expenses which is irrelevant to business activities.

For more on managing your fapiao’s, check out Invoicing and VAT Management in China.

Inventory Management

Warehousing and inventory handling of Company C is outsourced to a local warehouse and logistics service. After a year end stock-take, management of C found that the actual stock quantity of SKUs, inventory records on the system of their own and records on the system of outsourced service were all not matched. We were invited to do an investigation and provide a solution.

After walking through the whole inventory process, from order placing in C’s system to goods dispatching from the external warehouse, we discovered flaws and loopholes in workflows and internal control systems.

For example, there was an order of 1,000 goods purchased with only 100 stocks received. In the system of the outsourced service, only 100 units were recorded and no one noted that the rest of 900 units were not received until the year end stock-take as they only recorded what they actually received and dispatched. Serious issue was also found in company C’s system where there was no update record about this placed order at all. Even the 100 received stocks were not booked in the system.

There were two main reasons which caused those mistakes. First, clearly a coherent work procedure wasn’t in place to govern this inter-organizational inventory operation. There was also no staff assigned with clear accountability for works involving handover between organizations.

The lack of responsibility of employees and the outsourced service is the other main reason. For local workers, the error rate of the work carried out within their job duties can be quite high due to overlook and neglect. Moreover, Local employees tend to only concentrate on the works which are clearly assigned to them, and never take initiatives to report any other evident work flaws and errors that they can easily discern but believe not fall into their responsible area.

How to address the issues above

To count on employees themselves to properly carry out their work that meets your expectations is not a way out of hustles. Expatriate managers should always take a hands-on approach for managing China operation, including formulation of work procedures and supervision of work execution.

Under the constraints of time and resources, seeking a trustworthy business advisor who can work as your business partner is a good choice here to help oversee that your inventory operation is always on track.

Business advisor should work as a guardian for the business to:

- Check over the system and on-site work procedures whether they are thorough and robust to cover all business risks.

- Watch over the execution of work procedures to ensure that they are carried out properly in practice.

-

Constantly monitor client’s operations to identify problems and potential risks proactively. Cloud based inventory systems like Stoqo enables us to collaborate with you by sharing one set of inventory transaction data on a real-time basis.

For more on inventory management, talk to our expert agents at info@essential-acc.cn